by Nick Bachusky | Jun 11, 2014 | Amortization, CMHC, First Time Homebuying, Mortgage Trends, Real Estate Investing, Refinancing

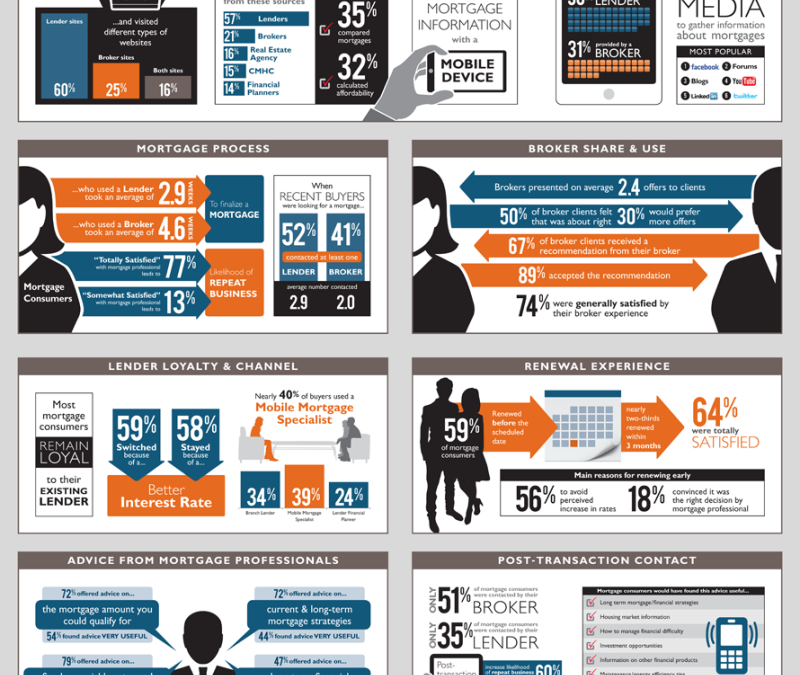

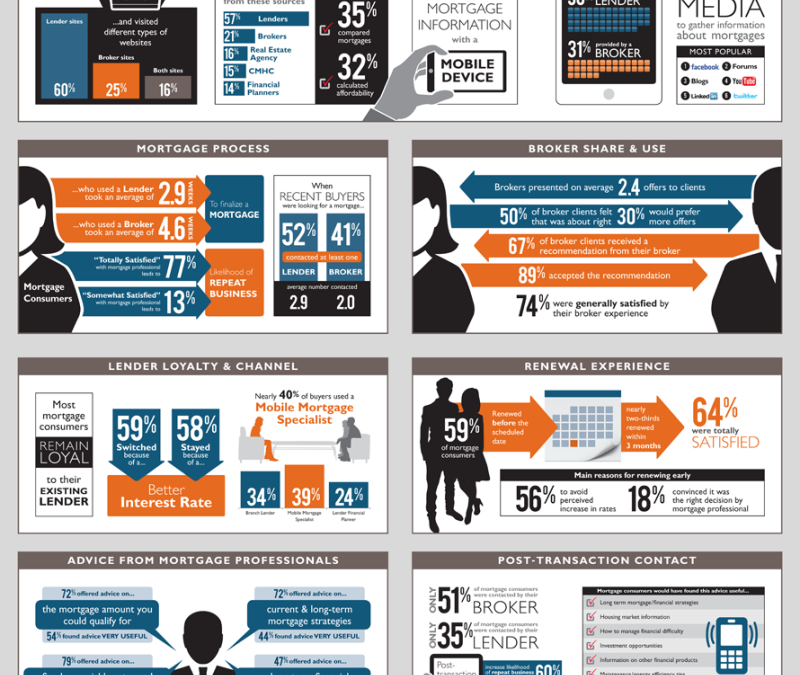

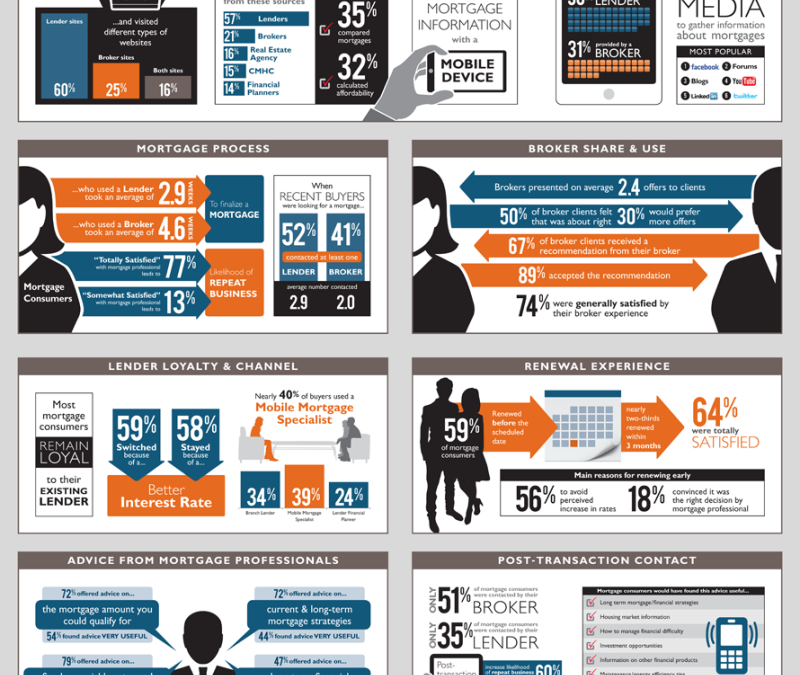

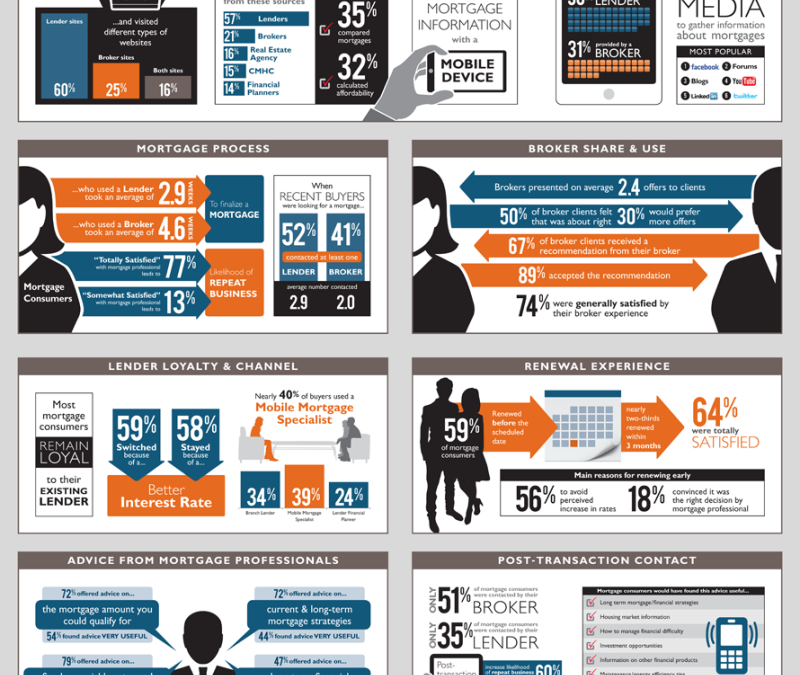

In March and April 2014, CMHC completed an online survey of 3,584 recent mortgage consumers, all prime household decision-makers who had undertaken a mortgage transaction in the past 12 months. Fifty-five percent had undergone a mortgage renewal, 22% had refinanced...

by Nick Bachusky | Apr 19, 2013 | First Time Homebuying, Mortgage Trends, Refinancing

I have had a lot of clients recently ask if there is anyway that they can get renovations or additions added to their mortgage, that they heard of some kind of program that would allow this? The answer is absolutely! Green Theory Design can assist you with all kinds...

by Nick Bachusky | Aug 13, 2012 | Amortization, First Time Homebuying, Refinancing

I have included some pretty solid information that you should take some time to read if you are serious about buying a new home or not exactly sure what it is I do. 1. If I have mortgage default insurance do I also need mortgage life insurance? • You should. Mortgage...

by Nick Bachusky | Aug 7, 2012 | First Time Homebuying, Mortgage Trends, Refinancing

1. What’s the best rate I can get? • Your credit score plays a big part in the interest rate for which you will qualify, as the riskier you appear as a borrower, the higher your rate will be. Rate is definitely not the most important aspect of a mortgage, however, as...

by Nick Bachusky | Jun 21, 2012 | Amortization, CMHC, First Time Homebuying, Mortgage Trends, Refinancing

Wow, so after many debates on whether Jim Flaherty was going to step in or not to try to stop the increasing debt to income ratio for Canadians, he announced some pretty drastic changes yesterday. They are going into effect on July 9th, so talk with your clients and...