CMHC just released their latest edition of Ottawa’s Housing Market Outlook and I will summarize what I feel are a few key points and interesting trends.

CMHC is not just your government mortgage default insurance lender but an organization that gathers much of Canada’s economic data and segments it based on where you live to let you know what you might expect in your area in the future.

You can read the full document on SodaPDF app or here.

Some data that we should not find too hard to expect:

-

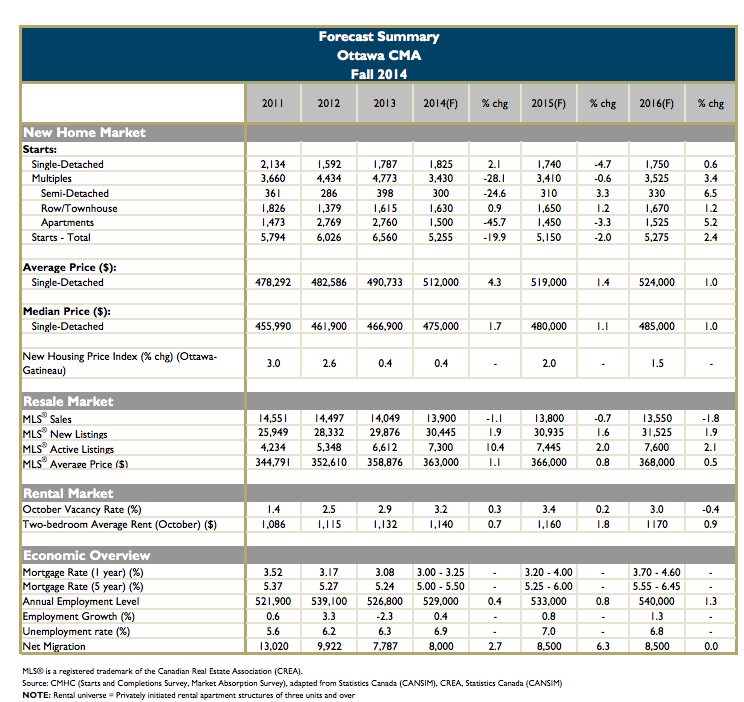

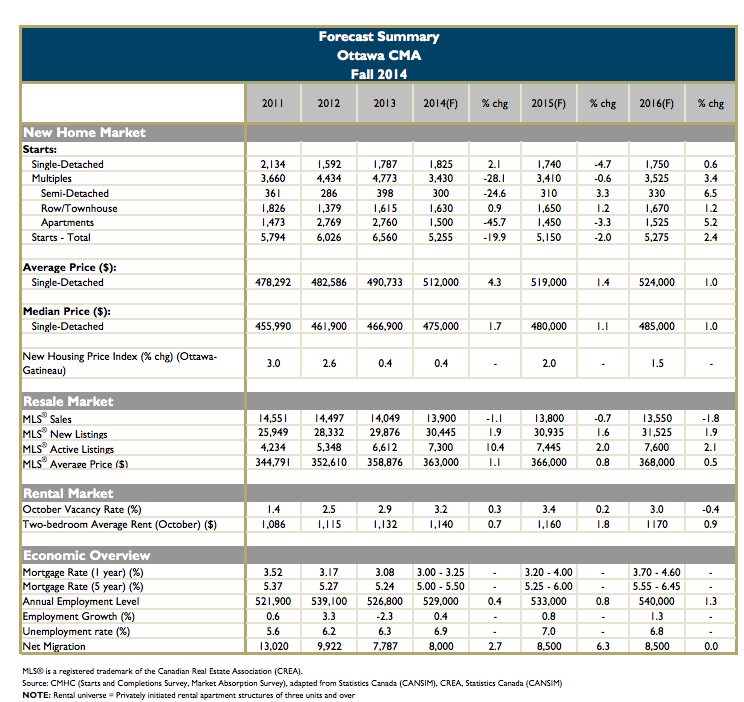

Housing starts are going to decline slowly in 2015. The main reason for this is that many of the condos area under construction and are finishing soon. We need to find more people to move into them before we can find demand to make new ones. 1000 fewer than in 2013

-

The price of a newly-built row unit averaged 32 per cent lower than a single-detached home year-to-date to September and was 830 square feet larger than the average condo size and only 3 per cent higher in price, making it attractive for some buyers

-

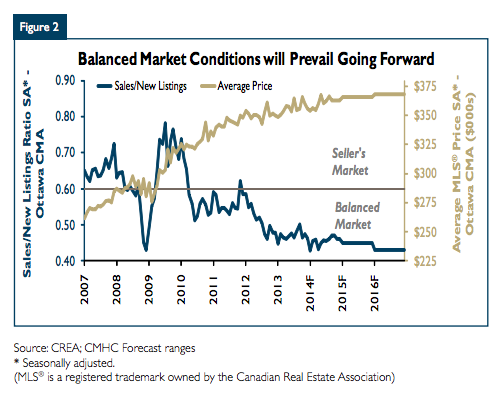

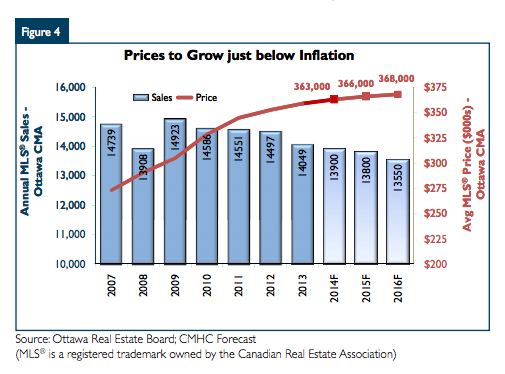

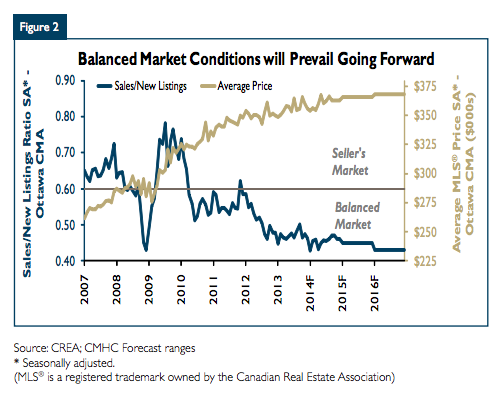

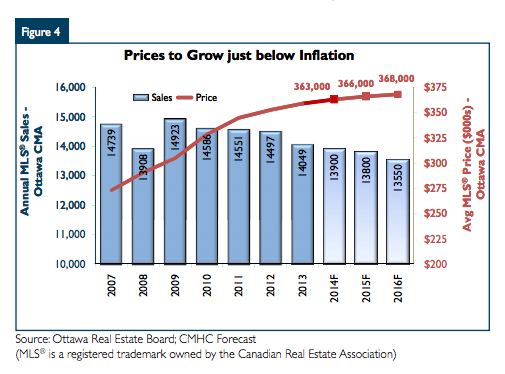

After a slow start to the home sales season, we picked it up in Q3 and Q4, but they are not expecting crazy increases in 2015-16.

-

By submarket, West Ottawa, which includes the submarkets of West End, Nepean, Kanata and Stittsville captured the highest share of resale transactions with 39 per cent. Property buying companies influence this market. Learn more about such company and the way it runs a business.

-

Orleans captured the highest share of sales year-to-date to end of September, reaching 17 per cent

-

Not surprisingly with all the new condos coming on board, rental vacancies will increase until 2016 when more jobs are expected to be filled.

Some data that I found interesting:

-

The price of single-detached homes are still rising steadily and getting out of reach for the first-time homebuyers in the 25-44 range so we are seeing a larger demand for row housing. They expect more first-timers to not go into the condos or suburbs but look for row housing closer to the downtown area

-

They look at the trend for developers to continue to build single-detached homes on the outskirts to continue. I didn’t expect this with so much talk from the city’s council on intensification and building around the LRT currently being built.

-

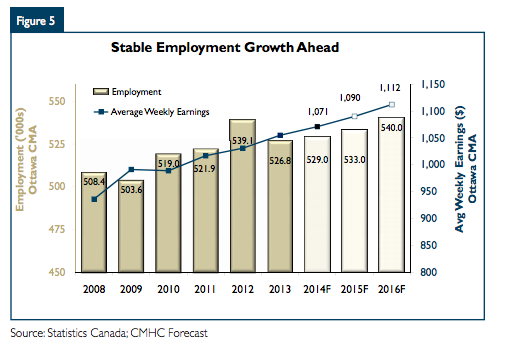

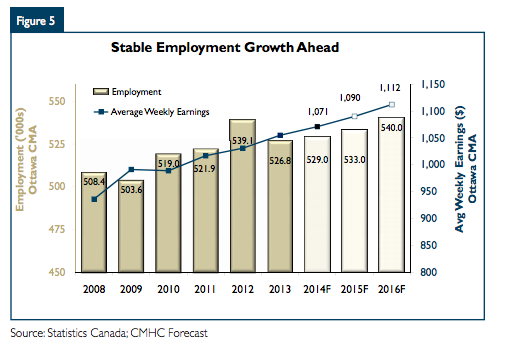

Even with government cutbacks to hiring, the CMHC still expects average incomes to rise more than 2% and the services sector is picking up steam with high paying jobs.

-

They are expecting 4000 jobs to be added next year and 7000 in 2016.

Mortgage Rate Outlook

Their mortgage rate outlook still uses the bank’s posted rate of 4.79% for 5 years fixed. I have rates in the 2.89% range as of today’s date.

So using the discount rate, they expect the range in 2014 to be 3.10%-3.60%. We have 2 months to go and bond rates are still low, so I do not see this being correct.

For 2015 they are looking at a 3.35% to 4.10% and 2016 3.65% to 4.45%.

With rates going up this means now more than ever, you need to work with a mortgage professional who will absolutely meet wuith you annually and stay in touch with you and coach you through these increases.