For first time homebuyers, there are many aspects to the transaction that often times it might seem a little overwhelming. My goal as a mortgage professional is to make sure my clients go through the process knowing that they can rely on me to get answers to any questions they might have. If I do not know the answer, I work with some of the most knowledgeable and quickest professionals in the home buying process, who will be able to answer your questions.

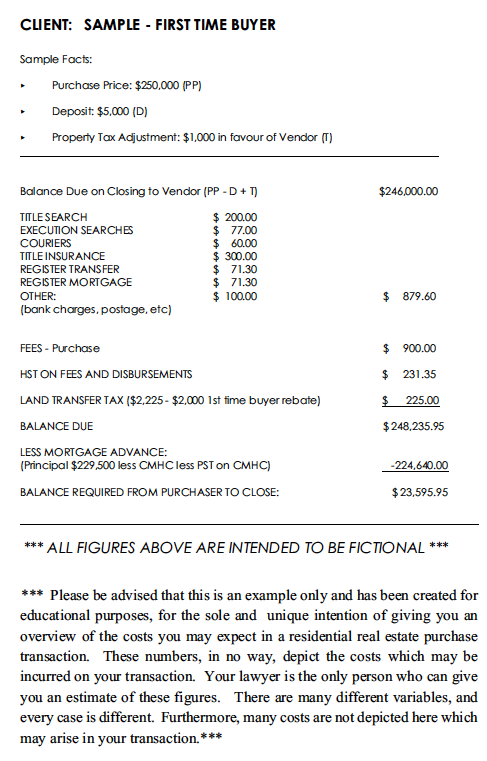

I recently met with Jennifer Ahde, real estate lawyer, because we wanted to clear the air on some of the most common questions that first time homebuyers have. She also provided a sample of the possible closing costs on a $250,000 property where the clients are putting down 10%. This is a sheet that she will provide to you upon closing.

– When do I meet my lawyer?

– How much money do I need to close the transaction?

– How will land transfer tax affect my transaction?

– What goes on on closing day?

The Second Thing I wanted to provide you with is a sample of how a real estate lawyer will present the exact amount of fees that will be required upon closing.

In this example we took a $250,000 home or condo with the clients putting down 10% or $25,000 and a $5000.00 deposit, of course there will be CMHC fees of $4500 factored into the mortgage plus $360.00 for the PST on the CMHC fees. We also took an assumption that the client purchased the house during the year and the previous owners have already paid for the property taxes for the year so they need to be reimbursed $1000.00.

This is just a sample of what the real estate lawyer will bring to you outlying the costs of buying your first home.

As you can see at the end the extra fees needed by the client at the time of closing (on top of the $20,000 for down payment) is $3,595.95.

Please make note of the Land Transfer tax credit not fully covering the tax amount.

Of course, if you have any questions please contact Jennifer or me anytime.

Jennifer’s contact information:

Email: jennifer@forteyarbique.com

Phone: 613-725-0303

Twitter: @homes_to_close