Today I attended a webinar from CMHC where they had the Deputy Chief Economist, Jeffrey Harris, speak on what their projections were for the housing market in Canada in 2016. He did stress these are projections and made a few jokes about economists and projections. This could be to the fact that they projected in Q4 of 2015 that a barrel of oil would end up between $40-$64 USD and today it is sitting around $29/USD. OECD even cut their global growth forecast today. They trimmed Canada’s GDP growth by more than any other country.

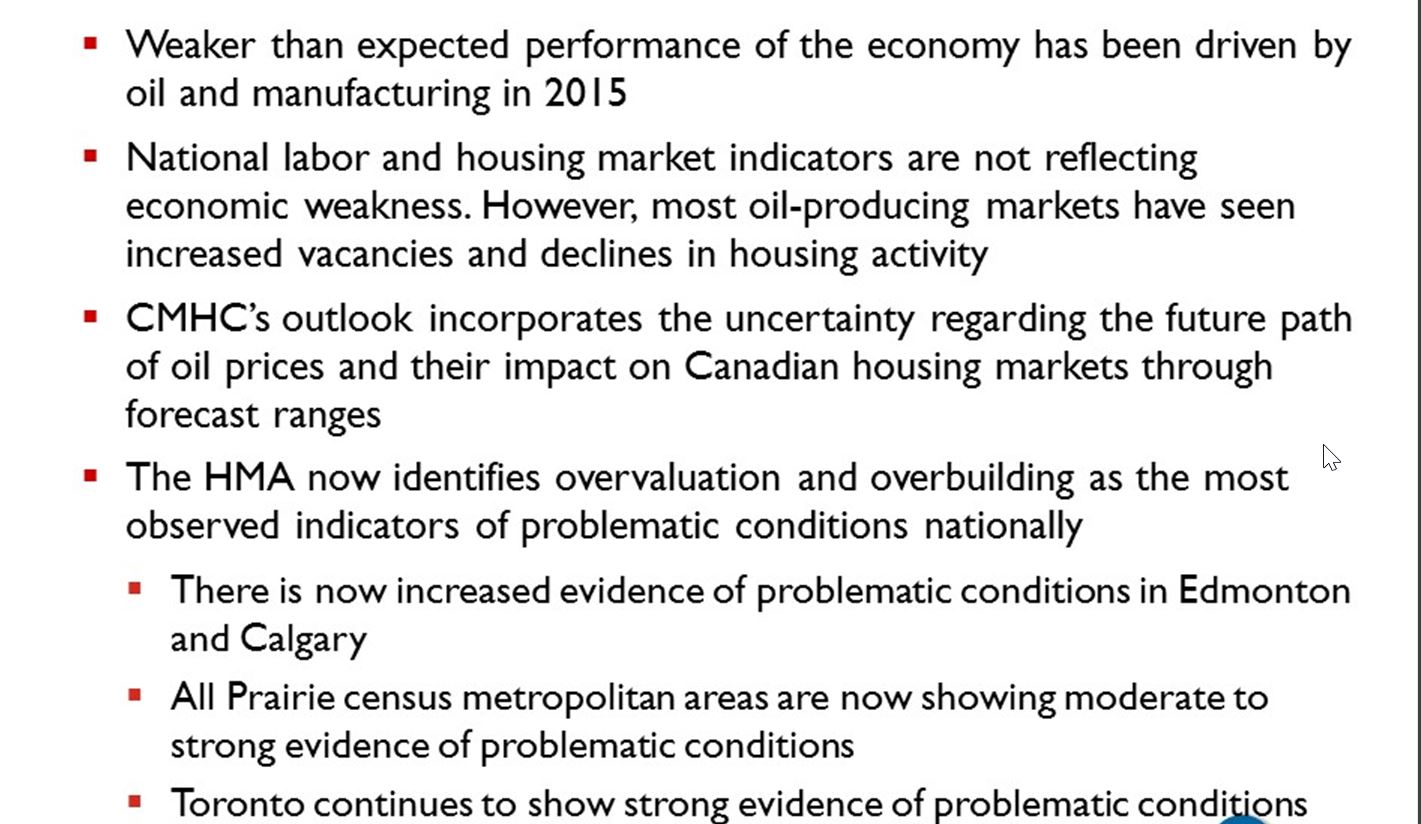

Here are some highlights:

– 2015 was very weak in terms of GDP growth (mainly due to oil in Alberta) but still had a resilient housing market (due to Vancouver and Toronto)

– There is a relatively stable employment national outlook with a migration of employees from Alberta to other countries

– The CMHC sees Ottawa with moderate problematic conditions due to moderate over building. This could be mitigated by supporting economic factors such as immigration and reduced housing starts.

– Ontario will continue to do well in housing market but the economy will have to adapt to the lower CDN dollar

– Unemployment at 7.2% currently

– They do not see large housing start increases in Ontario, mainly stable, large decreases ahead in Alberta

– Strong problematic conditions in Toronto, mainly due to overvaluation and price acceleration in the condo market. This can be mitigated by increasing incomes and immigration.

– CMHC sees overall weak problematic conditions in Canada.

– CMHC does forecast a rate cut from the Bank of Canada in the short term.

– They have very large forecast ranges for MLS price growth. In Ontario could see an increase of 10% all the way to a decrease of 6%.

Any other questions, let me know and I will try to find them out for you!

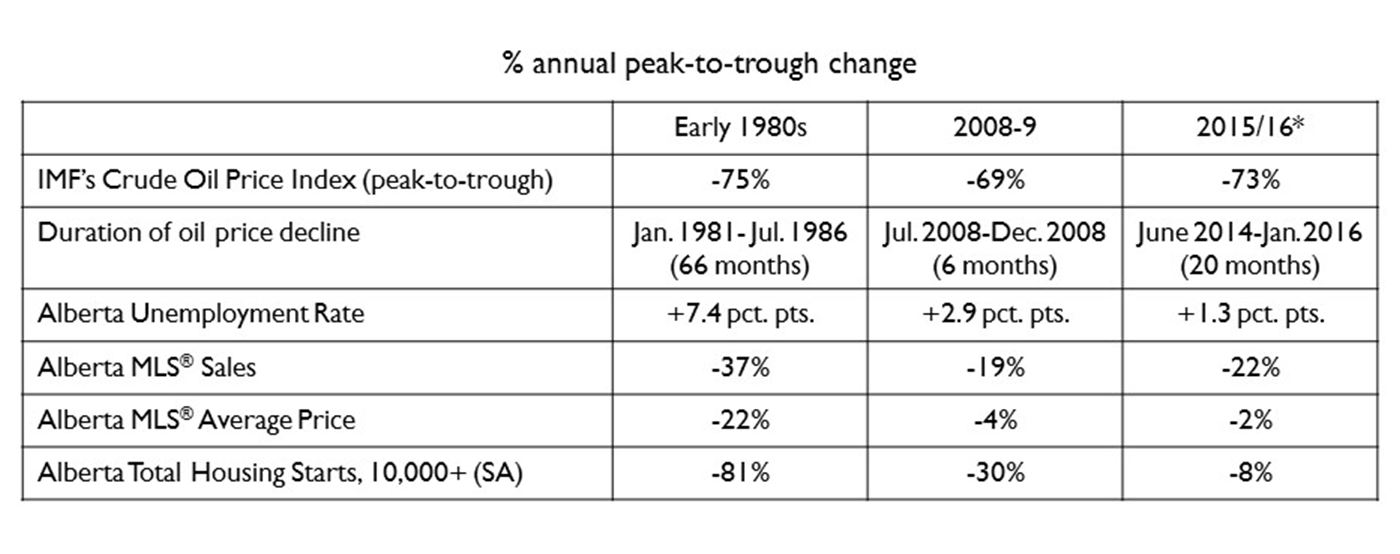

In Alberta

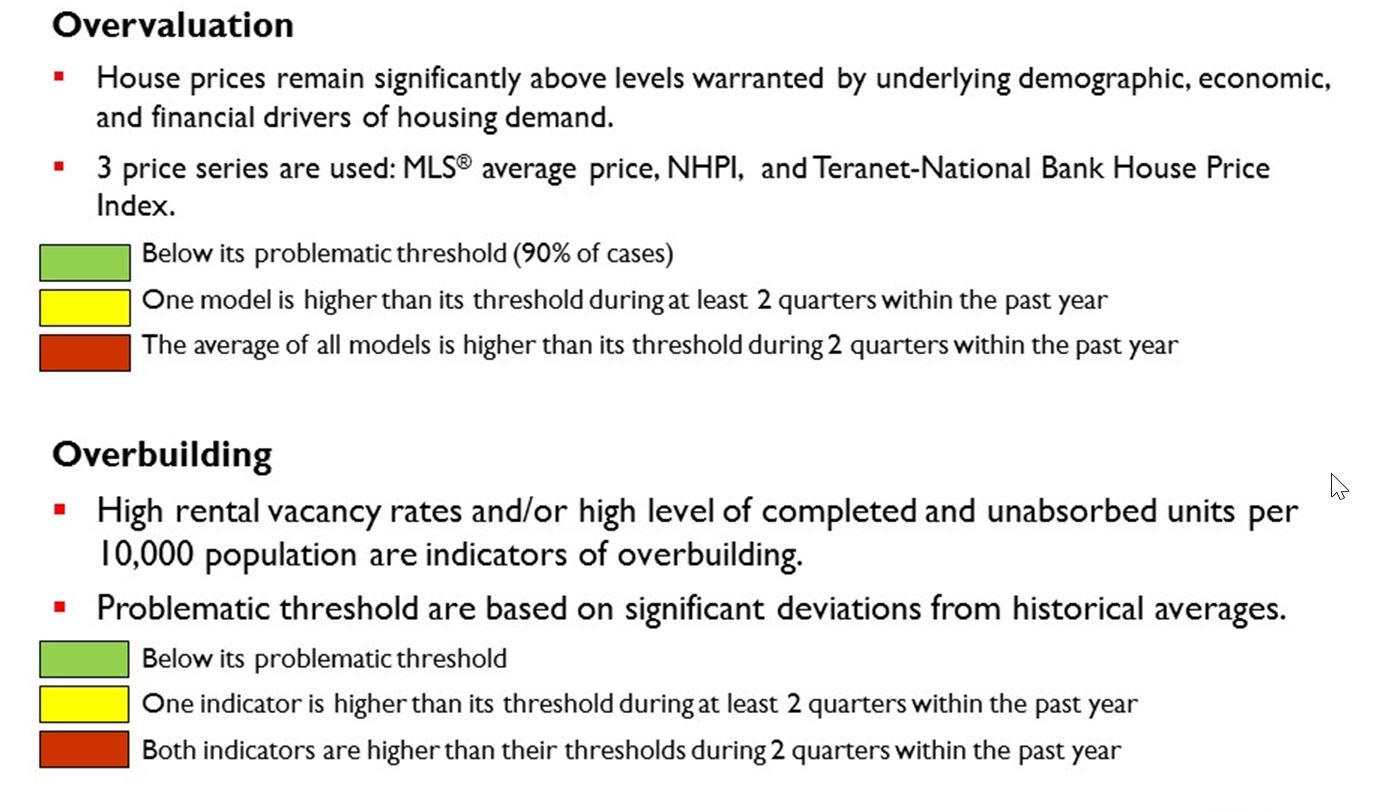

How CMHC values these indicators

Executive summary of the presentation