Wow, so after many debates on whether Jim Flaherty was going to step in or not to try to stop the increasing debt to income ratio for Canadians, he announced some pretty drastic changes yesterday. They are going into effect on July 9th, so talk with your clients and make sure they know the scenarios or get them to quickly call me.

The two main ones being the change to the way insured borrowers qualify and then the other being the changes to refinances going forward. Insured borrowers are clients that have less then 20% as a down payment and have to go with mortgage insurance from either CMHC or Genworth.

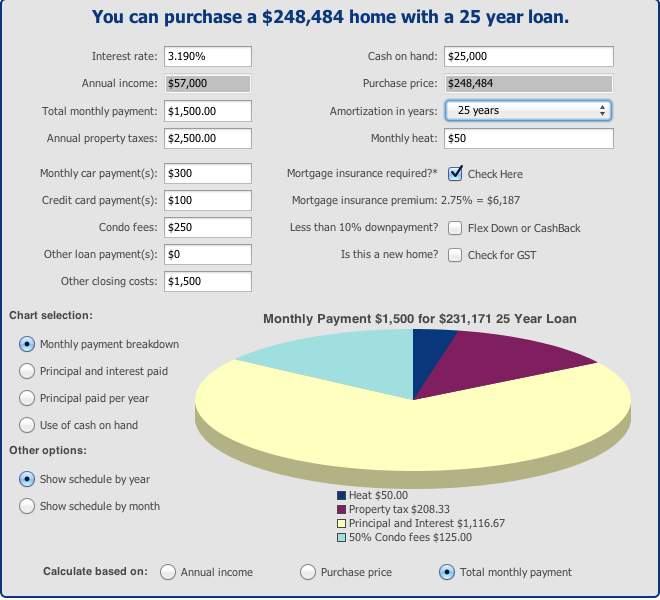

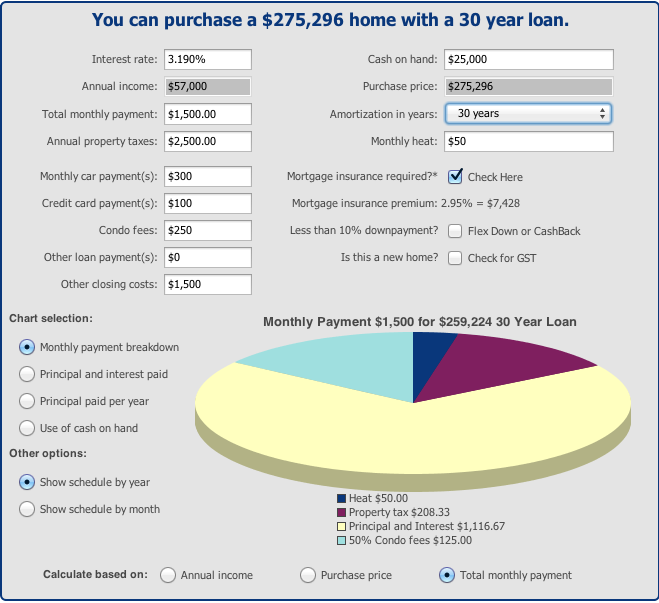

The first will probably impact first time home buyers the most. I would say quite a number of my first time home buyers now do go with the 30 year amortization to start mainly due to the fact they are moving away from renting and living away from their parents for the first time and want to establish realistic budgets. When I talk to my clients, I do work with them and explain to them that the mortgages I set them up with have very good prepayment changes so that if in 6 months they feel comfortable with their new surroundings, that they can increase their payments or put through lump sum payments and lower the amortization which will save on interest in the long term. This way they minimize the risk of requesting a loan modification with their mortgage companies. Unfortunately, a mortgage company can break the law and use illegal ways to demand mortgage payment. Check out https://chicagoconsumerlawcenter.com/respa/ to learn about federal law that was created to protect homeowners from such illegal actions. This I am putting in two charts that show the difference between two situations where clients are trying to qualify based on paying $1500 a month plus $250 in condo fees plus about $2500 a year in property tax payments. Disregard the income qualification because I work with my clients to establish the amount of house they can purchase based on low rates and a monthly payment that they would feel comfortable with and not make them house poor.

Here they are:

As you can see if clients want to stay in that $1500 monthly price range with all the other variables, the amount of home that they can qualify is a lot different. If the client needs to file for some bankruptcy services then it’s entirely within their possibilities to do so and the price ranges shouldn’t change too much.

The second major change is the decrease in LTV (Loan to Value) for a refinance. As of now we were able to work with 85% of the appraised value of the home but now we are at 80%. Clients like to refinance their home and not use a unsecured line of credit to take advantage of the much lower rates and use a larger amortization to increase cash flow. Please, find here clear and detailed va home loans rates.

Thus this brings the absolute importance of talking about purchase plus improvements with all of your clients. If they buy a house in the 85-90% LTV range they must wait about 5 to 10 years before they can take advantage of the equity in their home and use their ability to refinance.

The last major change is that for homes in the $1 million dollar and up range, the down payment must be 20% or higher.

Hope this helps! Have a great day and make sure to ask me any questions at anytime!!