by Nick Bachusky | Dec 8, 2014 | Closing Costs, CMHC, First Time Homebuying

Genworth, a top default mortgage insurance provider in Canada, has a great mortgage option for the many parents of new students heading to the Universities and Colleges. The benefits of The members of the family must have proven good credit. Looking at the fees...

by Nick Bachusky | Nov 28, 2014 | First Time Homebuying

Congrats! I have updated you to tell you that all of your documents have been accepted and the mortgage documents have been forwarded to your lawyer. As you may know,I like to get this completed roughly 2-3 weeks ahead of your closing date (I love making...

by Nick Bachusky | Nov 14, 2014 | CMHC, First Time Homebuying, Mortgage Trends

The infographic that CMHC produced can be seen and downloaded at the bottom. The reason I write on this survey is because it helps me find the possible gaps in my business practice & allows me to continuously improve. It also motivates me to continue on everyday...

by Nick Bachusky | Nov 8, 2014 | CMHC, First Time Homebuying, Mortgage Trends

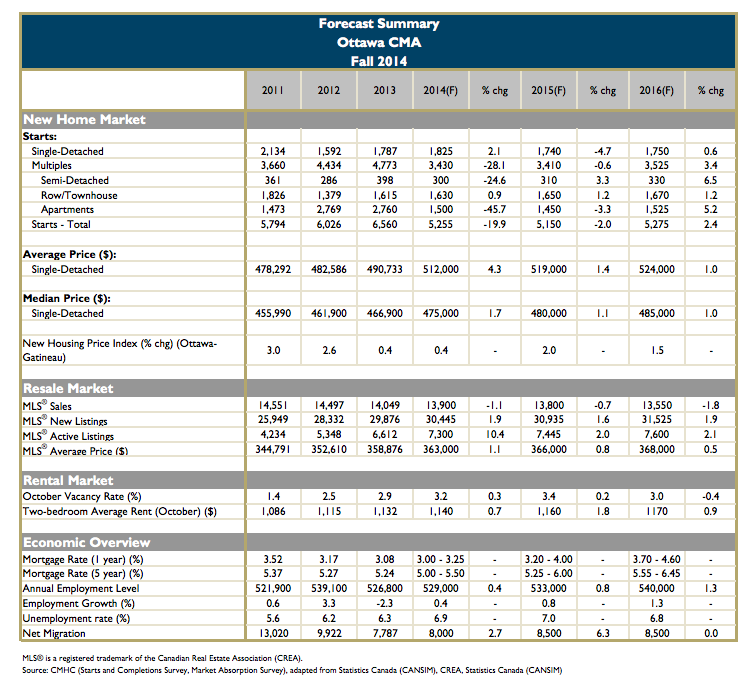

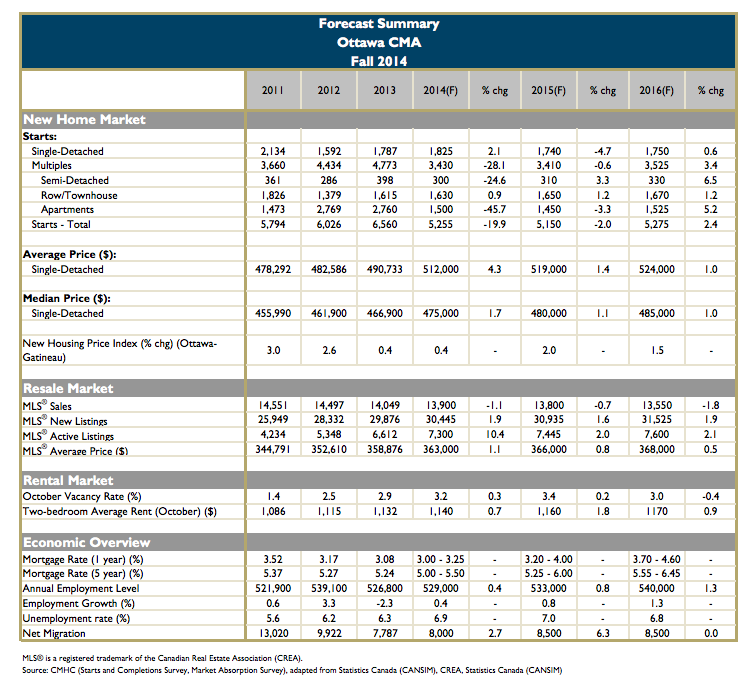

CMHC just released their latest edition of Ottawa’s Housing Market Outlook and I will summarize what I feel are a few key points and interesting trends. CMHC is not just your government mortgage default insurance lender but an organization that gathers much of...

by Nick Bachusky | Sep 25, 2014 | Closing Costs, First Time Homebuying, Mortgage Trends, Real Estate Investing, Taxes

This is a very interesting article written by one of Ottawa’s most trusted realtors, Ryan Jones, who I have the pleasure of working with. I thought that we should have more people know about this potential reality because it could really impact their...

by Nick Bachusky | Aug 22, 2014 | First Time Homebuying

The other day on Reddit, a 28 year old prospective new first-time home buyer asked the people of the Internet to help him figure out what past first-time home buyers might have overlooked, here are some of the comments that I think could help you: ...