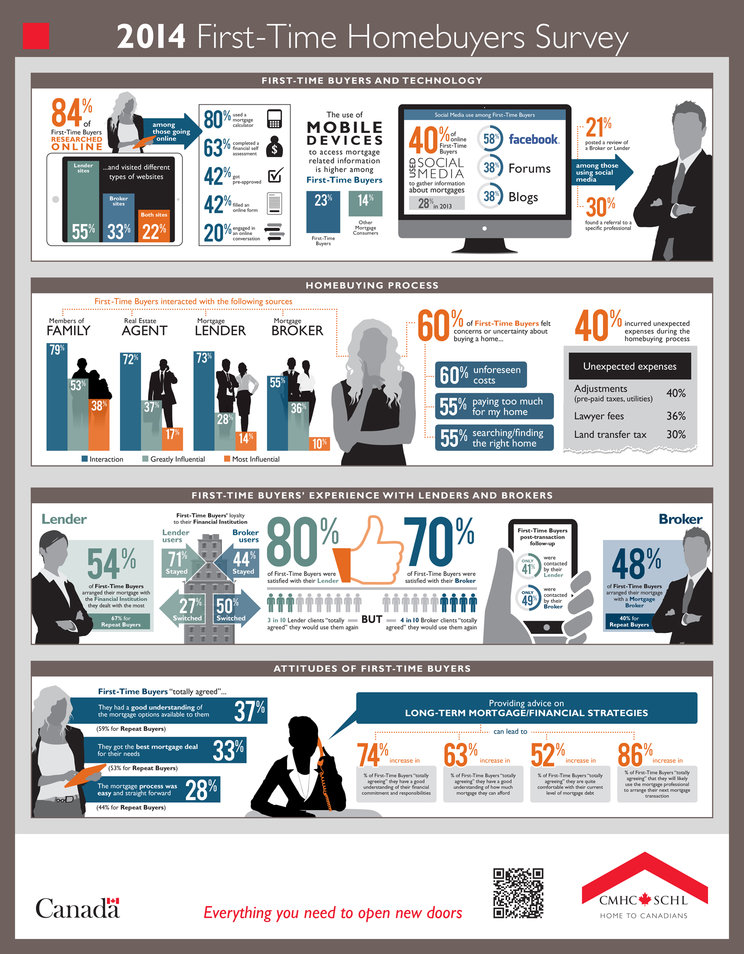

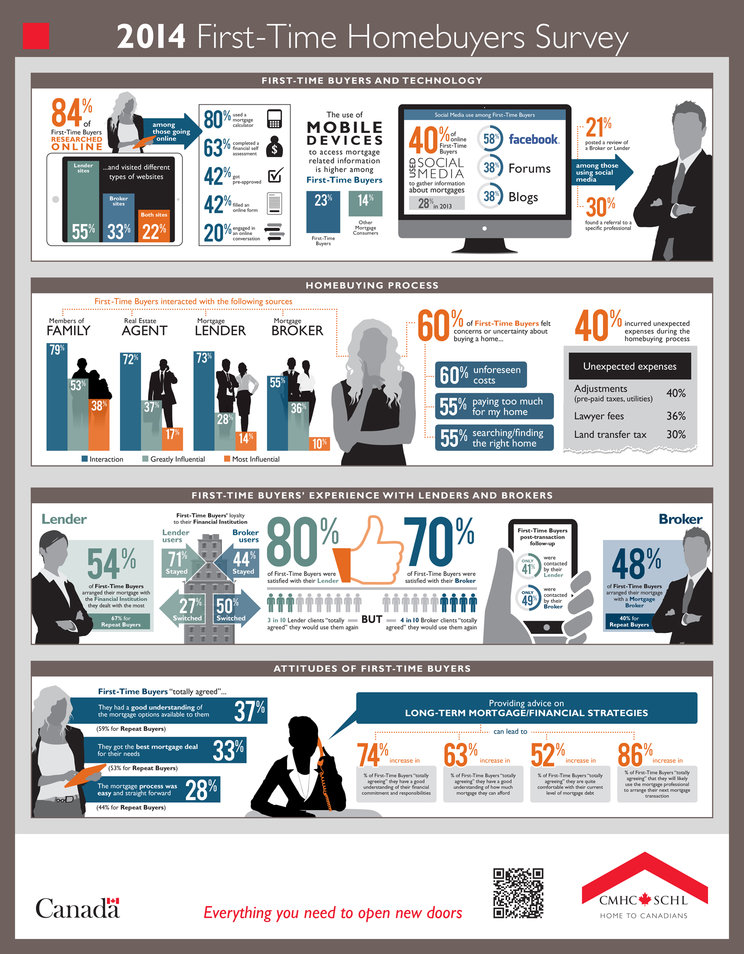

The infographic that CMHC produced can be seen and downloaded at the bottom.

The reason I write on this survey is because it helps me find the possible gaps in my business practice & allows me to continuously improve. It also motivates me to continue on everyday to get Ottawans and Canadians to stop thinking the bank is the best option for financing the largest purchase in your life. I thank the CMHC very much for putting this unbiased survey together.

My takeaways from the survey:

-

I like that First-Time Homebuyers (FTHBs) are going to broker sites more now, proving the younger flux generation understands that businesses like mine can become more efficient with technology and service where the banks very much are lacking.

-

80% of FTHBs going online to use mortgage calculators. I do not think this is always a good idea because too many calculators do not figure out CMHC/Genworth fees so they get the wrong information. I am more than happy to do any calculations at anytime for my clients so they know they are getting the right figure immediately.

-

63% went through a financial self assessment. Once again, I want my clients to be doing this with me because I see too many variables that are not considered and people generally have many questions and I am more than happy to go over them with them.

-

40% got info from social media. I do not have a Facebook page because I have seen other mortgage brokers and they are full of generic, useless information that clog that medium up. Instead I will post occasionally on LinkedIn but believe my blog is the best source. 44% of FTHBs are using blogs, I hope you find mine.

-

During the home buying process, 79% of FTHBs go to family members for advice, of course they are the most trusted and most influential.

-

60% had concerns during the home buying process. This is normal on the biggest purchase of your life. I just want you to know with me you will not be surprised about these additional fees. I will remind every client about these. The unexpected costs include adjustments (pre-paid taxes being the top), lawyer fees and land transfer fees.

-

Still a terrible stat is that 54% of FTHBs went to the financial institution that they were originally with.

-

48% went with a mortgage broker. This is good news and will continue climbing

-

85% of those who used a broker (a true professional) went with an institution that was not their original. This tells you something.

-

Only 4 in 10 FTHBs would “totally agree” to go with their mortgage broker again.

-

33% only said they thought they got the best deal for their mortgage. I can only assume this is from banks or clients referred to banks from realtors. I must stress once again, I have worked at the 2 largest banks, the fact that you have banked their for years means absolutely nothing to them. My clients will always get the best deal that works for them.

-

Only 4 in 10 totally agreed they had a good understanding of their mortgage options. Once again, this is sad.

My main concern:

-

Fewer than half the FTHBs received a post transaction follow up form their mortgage professional. This is terrible. All my clients are contacted on a monthly basis through my newsletter and we do our annual mortgage check ups. Of those 50% or so, it is usually just for a thank you. Fewer than 40% from a bank! That means you are trusting some faceless company to manage the most expensive transaction of your life blindly for the most popular 5 year fixed term.