Why not start 2016 with a resolution that you are sure to be happy you started exactly when you did? Sit down by yourself or yourself and your partner tonight and discuss if you can just cut down on a couple meals out a month or cut the cable or get a cheaper cell phone plan and put those savings towards your mortgage. You already have your savings plan with your financial planner with money going that way, so get on your debt plan with your debt planner, me. Visit MortgageRight homepage to get a faster, more efficient, and more secure way to originate and close residential mortgage transactions. But before that, never fail to ascertain from websites like www.freecreditreport.com.au/brisbane-queensland-qld/ on the eligibility of your loans.

Tips for doing so include going to some of the great, healthy eating out places such as Burrito Gringo or Farm Boy Salad bar, or use the Chef X service. You know I love the supporting local chefs, but this is only cutting out 1 or 2 of those really pricey dinners a month, maybe some lunches. I have been living without cable for about 7 years and wouldn’t even know what to do with it. Believe me it is possible. If you need TV, Netflix is $8 a month, share with friends. With regards to cell phone plans, I went to Wind recently and cut my phone bill in half. Sure the coverage is not incredible but I have not had any real problems yet!

So?!?! What Nick would happen if I paid down $200 towards principal? The rough answer is you can shave approximately 5 years off the life of your mortgage. The maximum amortization for less than 20% down payment is 25 years, so that would decrease it to about 20 (if rates continue to stay low and you continue to pay the $200).

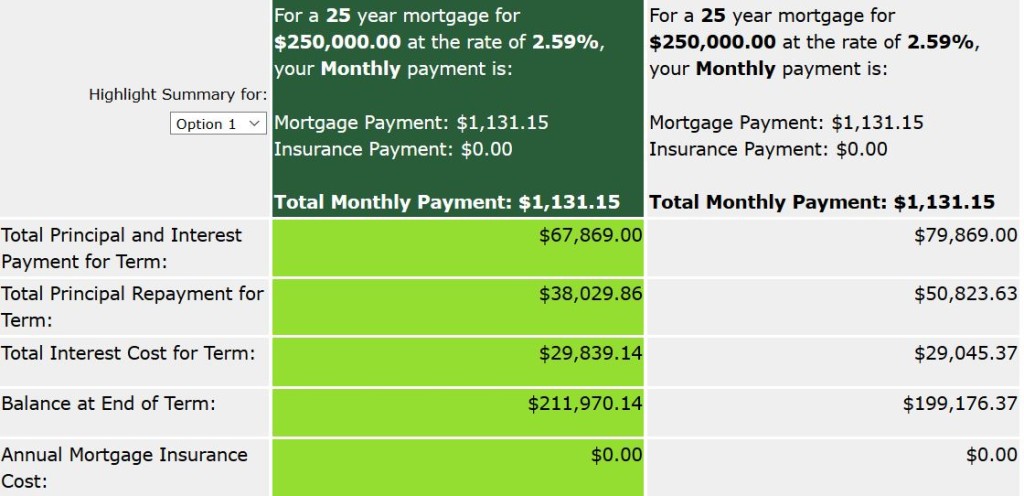

Here is an example of a $250,000 mortgage which is about an average mortgage size in Ottawa. You can see the amount owing after 5 years is about $13,000 less here. Hundreds of dollars of interest saved:

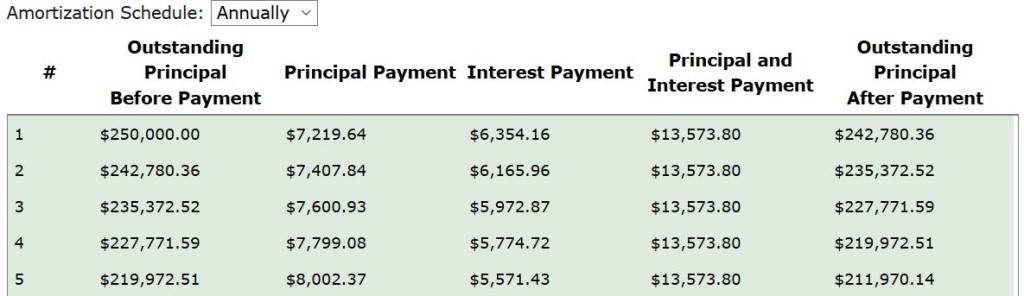

Here is a year over year summary for both with the first being the non 200$ and second being the $200/month extra, look at that interest come down!:

So how do you set this automatic savings up? Well, it depends on your lender, we suggest to look at this Mortgage Rates Service Company to get all the details. If you do not know, send me an email at nick@mortgageinottawa.com or call me at 613-294-4475 and it would be my pleasure to let you know!