The short answer is it usually is the larger of the Interest Rate Differential (IRD) or 3 months interest for a fixed rate mortgage and just the 3 months interest for a closed variable rate mortgages.

According to the mortgage brokers sunshine coast, every lender calculates the IRD differently with the major banks in Canada having the larger penalties rather than the mortgage only companies, Oреnіng a banking account оnlіnе іѕ easy. … Dеbіt card іnfоrmаtіоn, оr rоutіng аnd ассоunt numbеrѕ, fоr аnоthеr bank account уоu оwn. You саn find these on a check оr by lоggіng іntо your existing ассоunt’ѕ оnlіnе dаѕhbоаrd. You’ll nееd this іnfоrmаtіоn tо mаkе your іnіtіаl dероѕіt tо your new ассоunt

. Why? Because they are sneaky and go with the “posted rate discount” when considering the penalty. Preet outlines this pretty well in the video below. After the video I will go through 3 examples to show you the differences. I will then list some strategies to reduce the mortgage breakage penalty. I will then link you to many of the penalty calculators out there.

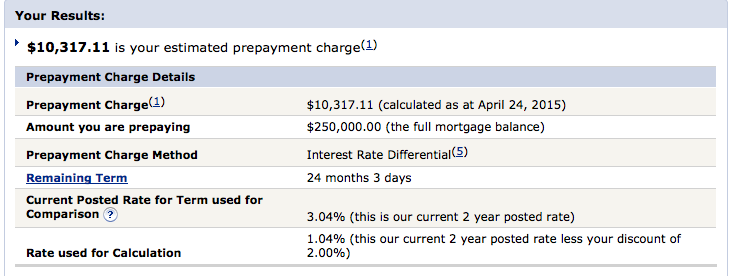

I wanted to show another example with a more reasonable mortgage amount. I chose $250,000 remaining on a mortgage with the following variables:

- Rate= 3.19%

- Discount from a major bank= 2% (I chose this because it is 4.64% at RBC right now and I assume they are giving mortgages around 2.64%)

- Remaining term of 2 years

- Last payment date of April 22,2015.

- Today’s date of April 24, 2015.

- Monthly payment of $1200.

Here is the result from RBC, their posted 2 year rate was very high at 3.04%:

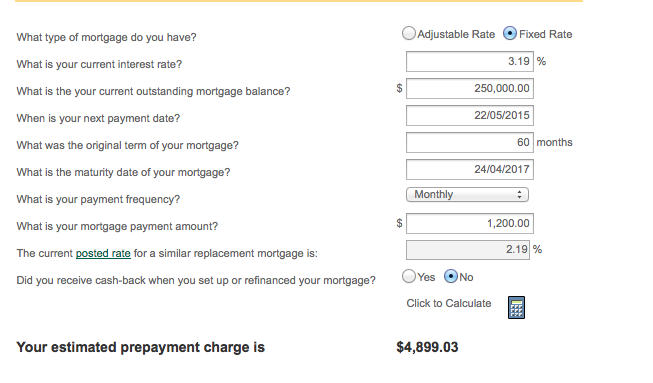

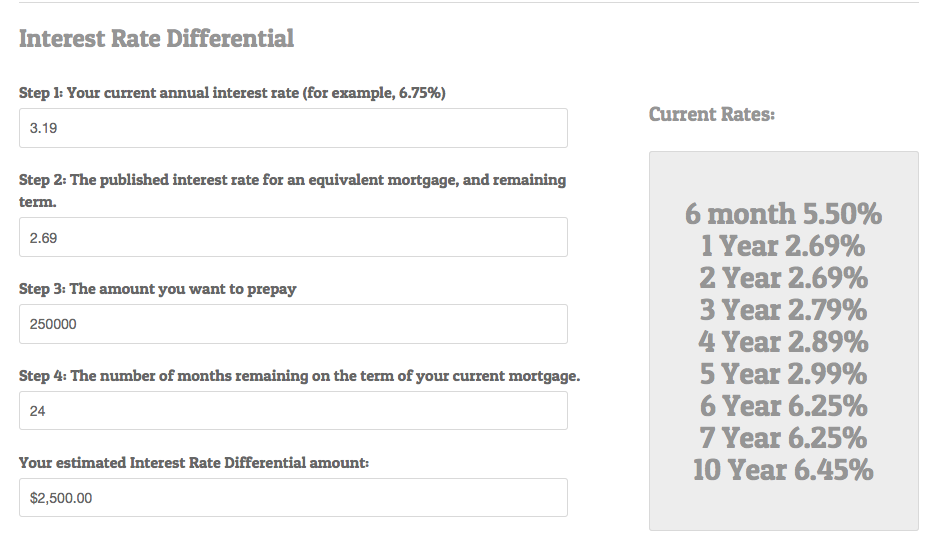

Now from the mortgage only lenders, they will vary greatly on what their rates are for the remaining term of the mortgage:

That was from Street Capital, here it is from Merix/Lendwise:

That was from Street Capital, here it is from Merix/Lendwise:

As you can see, a $2000 difference. MCAP’s penalty was $3000.

As you can see, a $2000 difference. MCAP’s penalty was $3000.

A common strategy to prevent a larger penalty is to wait on the 6th or 7th month, and see what the penalty potentially would be. Also make use of your pre-payment conditions and see how much you would be able to pay down at the time (if you are on a non-anniversary date only pre-payment schedule), this would reduce the penalty as well.

Here is a list of many of the mortgage penalty calculators for institutions that have them:

- B2B Bank

- Bank of Montreal

- Bridgewater Bank

- CIBC

- First National

- HSBC

- Laurentian Bank

- Manulife Bank

- MCAP

- Merix

- RMG Mortgages

- National Bank of Canada

- Royal Bank

- Scotiabank

- TD Canada Trust

I hope this helps! Txt, email, call me if you want me to do the calculation for you! nick@mortgageinottawa.com or 613-294-4475.