These are carefully selected passages from the 12 page PDF report factoring in Ottawa with some commentary from me.

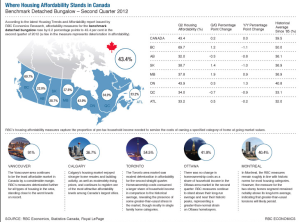

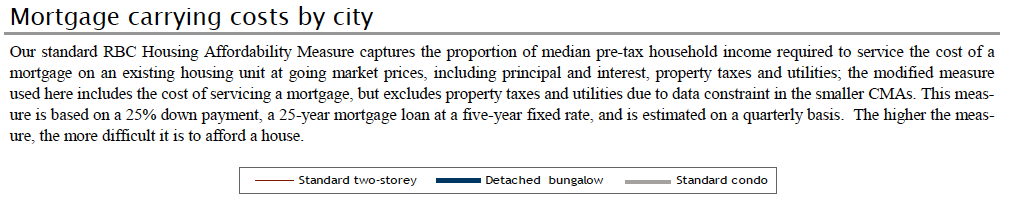

Steady affordability across the boardThere was no change in the costs of owning a home as a share of household income in the second quarter in the Ottawa-area market. Increases in income fully offset increases in mortgage payments (changes in utilities and property taxes were negligible). This was true for all housing categories that they track, as none of the RBC measures moved in the quarter. The RBC measures, therefore, continued to stand not only above their long-run average but also near historical peaks in the area (albeit low ones by major Canadian city standards), which means that affordability still represented a somewhat greater than usual strain for Ottawa homebuyers. This strain, however, has had little adverse effect on the market so far if we consider that the market just registered its third-best ever second quarter in terms of home resales. Nonetheless, resales’ momentum shifted down in the past two quarters from the brisk pace from last year, and month-to-month volatility increased. Thesemay be early signs that homebuyers may feel increasingly stretched.

I have been reporting on many of these figures lately on Inside Mortgages This Week.

Here we are looking at the Detached Bungalows.

Standard Two Storey Homes RBC Housing Affordability Index

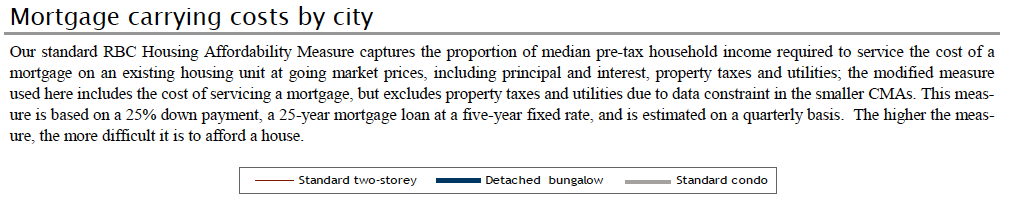

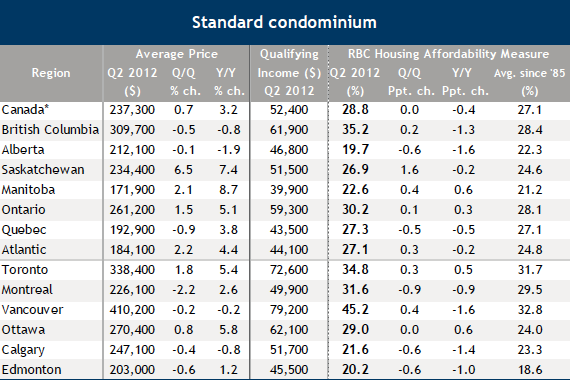

Ottawa Condos RBC Housing Affordability Index

Housing Affordability Across Canada

Where Housing Affordability Lies in Canada

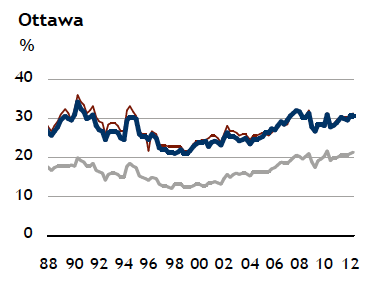

Housing Affordability over the Years for Ottawa

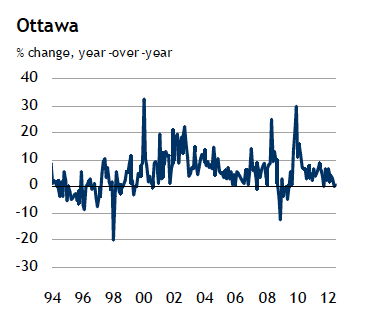

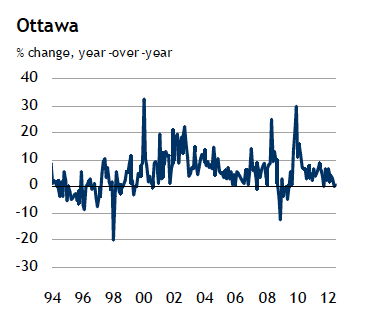

Average Price Change in Homes using MLS for Ottawa

Average Price Change in Homes using MLS for Ottawa

Average Price Change in Homes using MLS for Ottawa

Ottawa Home Sales to New Listing Ratio

Here we are seeing the trend I have been talking about moving from the balanced market in Ottawa to a more buyer’s market. I expect this trend to continue.